The Roadmap to Wealth and Independence

with Peace of Mind

Phil Chomo grew up in Worcester, MA in a family of three boys with immigrant parents. One of his strongest memories in early life is that he always worked. In grammar school Phil delivered morning papers and had once received about $25.00 in Christmas tips. His mother had asked him to give that money to his father who had been laid off from work. Phil was so pleased to be able to help his family.

Throughout high school Phil had, at times, caddied, washed cars, and worked shining shoes including Friday nights, all day Saturdays, and on Sunday mornings for $5.00 pay and tips. He also worked as an office boy in a law office. He knows that working played a big part in influencing his character. This gave him profound respect for the time and effort it takes to provide for one’s family and their needs. Phil graduated from Northeastern University with a B.S. in Industrial Engineering, and completed his military duty serving in the Military Corps.

Phil, his wife Sandra, and three children, attended St. Demetrios Greek Church in Weston where he served on the board, was a member of the choir for 38 years, and president of the “Fifty Somethings”. For Phil, his philosophy is that the Lord has given him quite a journey from the cold water, three-decker tenement in Worcester, to their current life on Nantucket Island.

In his spare time, Phil loves to read, cook pancakes on Sunday mornings, fish, clam, practice Chi Gong, entertain, tell his grandchildren funny stories, and sit on the beach with his wife and a bottle of rose, watching the sunset over Madaket Beach.

The most important things in Phil’s life is to strive to be a good husband, father, grandfather, friend, and advisor. For him this is an ongoing project that he many times succeeds at, but at times fails miserably. For him, life is not so much the goal but more so the journey. Every day might offer a new lesson.

Phil has spoken before many groups about his own integration of body, mind, and spirit into all aspects of life. He has practiced the Chinese art of Chi Gong for over 25 years, where the goal is to rid your body and mind of all toxins. This inner life flow helps maintain health and compliments the awesome power of the Holy Spirit. Phil’s wife won’t allow him to go to bed without him completing his Evening Meditation. Without the Meditation, he snores!

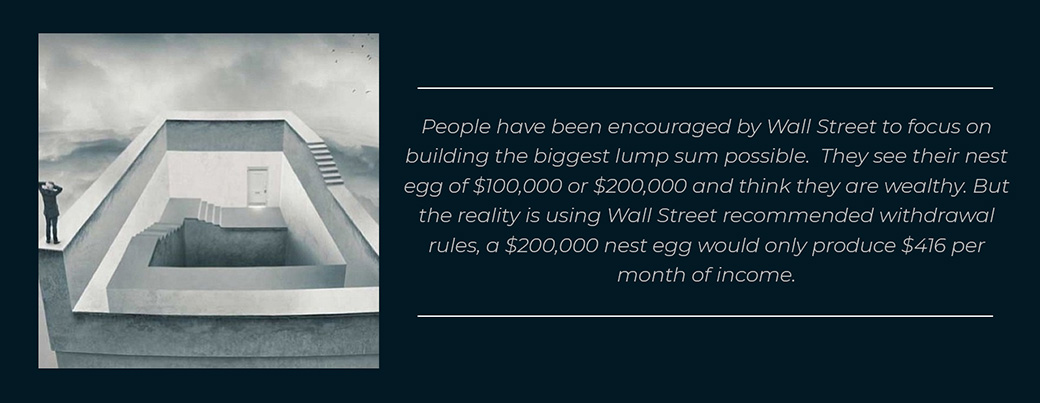

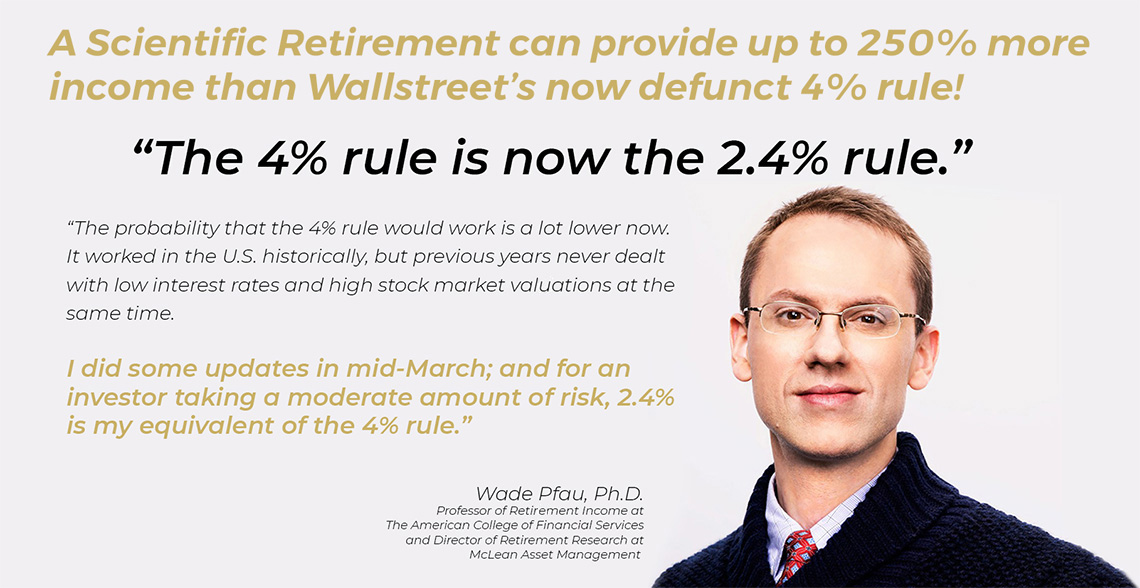

Say goodbye to the worn-out advice that has you on a financial roller coaster. Contrary to what the Wall Street media machine promotes, you don't have to risk losing your hard-earned money to grow wealthy. There is a simple and clear plan to grow wealth with peace of mind. This book will give you the blueprint of how to do it.

“There’s a big difference between wealth and income.

Knowing I have a million dollars doesn’t tell me the lifestyle I can enjoy from that million. What we care about is the lifestyle.

So you can forget fund values, income is all that matters. Just knowing how much money you have doesn’t tell you how you can live. You need to know how much you can buy.

The primary concern of the saver remains, what it always has been: Will I have sufficient income in retirement to live comfortably?”

An untimely death or accident can create additional stress and financial pressure on our closest loved ones if we don't plan ahead.

A single 20% or 30% market crash can not only hurt your account balances, but it can cause you to run out of money years sooner.

CPA and Tax Expert Ed Slott says “Taxes are a larger risk than market crashes.” If you have all your retirement income in qualified plans like IRAs and 401(k)s that require you to pay taxes when you take the money out, you have a huge tax liability.

Statistics show that long term health care costs can be the largest expense in retirement. What have you done to protect your nest egg and your family from being hammered by this expense?

Will your nest egg provide enough income to give you the retirement you want, for as long as you live? Most people have no idea.

Longevity is the great RISK MULTIPLIER. Do you know how long you will live? Hopefully a long prosperous life. Longer life spans multiply the likelihood of each of these risks happening to you.